To claim your expenses you need to be registered for e-Pay. The instructions how to do this can be found in the FAQs below.

If you have Epay (expenses) query please email AGCSU.esrsupport@nhs.net

FAQ’s

-

How do I register for e-Pay?

Click on the link to register for ePay: Epay Registration Our organisation number is: 116 NHS Lincolnshire ICB

-

How to claim for excess miles on e-Pay once you have registered

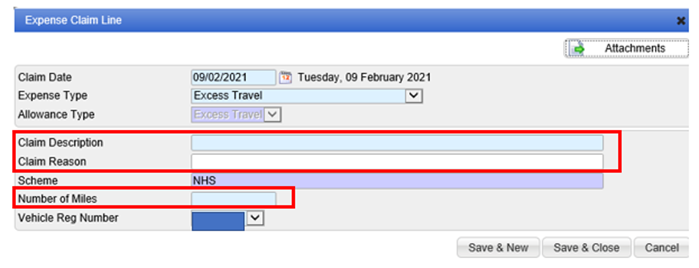

To claim excess travel in e-Pay, you will need to choose the 'Excess Travel' element in the ‘Expense Type’ field, the ‘Allowance Type’ will auto populate as per the screen shots below, and then enter a 'Claim Description', 'Claim Reason' and enter the total number of excess miles they are claiming in the ‘Number of Miles’ field:-

-

A guide to claiming excess miles with example claims

This document is intended to be a helpful guide to support staff in claiming mileage in line with the Travel and Expenses Policy.

Please see a guide to claiming excess miles with example claims.

-

How do I logon to e-Pay?

To logon to e-Pay, please click this link: Epay log on

-

I have registered for ePay but it says waiting for approval and I can't claim?

You need to ask your manager to log on and approve any outstanding registrations which is on the bottom left of their home screen.

If your manager cannot find the registration request, they will need to contact the ePay administrators by email at agcsu.esrsupport@nhs.net.

-

What is the expenses deadline?

6pm on the 10th of every month. However, we recommend that you submit your expenses as early as possible. Where expenses are submitted on the last day (the expense deadline) the HR team may be unable to resolve queries in time for payment in that month. If you claim is approved after the deadline you will receive payment in the following months’ salary.

-

My account is locked out?

When you enter your password incorrectly 3 times in a row, you are blocked for an hour. After the hour has elapsed, you can have another 3 attempts before being blocked for another hour.

To reset your password use the forgotten password link. Alternatively, please email agcsu.esrsupport@nhs.net and we will arrange for it to be unlocked.

-

Who sets up my vehicle on e-Pay?

The employee enters their own vehicle in e-Pay. When the employee enters a claim using their vehicle for the first time, upon submission of the claim, the employee will need to agree to audit checks confirming that the manager has seen the vehicle details.

On approval, the manager will have to agree the same audit checks. Clicking on the ‘Help’ button in e-Pay shows documentation on how to set up a vehicle.

-

How are expense claims approved?

Claims must be submitted by the 10th day of the month.

When you submit your claim it is sent to the 1st approver (Usually a manager who has been designated to approve expenses in your team). They have 4 working days to approve your claim.

If your claim is not approved in four days then this will be escalated to the 2nd approver (Usually a more Senior Manager). They have to working days to approve your claim.

If your claim is not approved then the e-pay team will reassign your claim and the process will begin again.

Please try to avoid submitting your claim at the last minute so that your manager has time to approve the claim. If you submit your claim on or after the deadline, your claim is likely to be paid the following month rather than the current month as there will not be enough time to approve it.

-

I have submitted my expenses claim but my manager is away?

If your manager is away, then after 6 working days the claim will escalate to your "managers manager" to approve.

However, if you have submitted your claim near the deadline (10th of the month) then your expenses may not be approved in that months’ salary as the escalation will have occured after the deadline.

If your manager is away, they can set up a substitute approver. If they do not then the system will approve your expenses as detailed above.

Substitute approvers need to be requested by e-mail by the current line manager. The substitute manager must be an approved signatory for e-Pay purposes and in the same team. This request should be made before the manager goes on leave or the request cannot be actioned. If you wish to set up a substitute approver please email AGCSU.epaysupport@nhs.net

-

How do I change the e-Pay approver for my employee or team?

You will need to complete the e-Pay1 form and send it to AGCSU.esrsupport@nhs.net.

-

If I am a substitute approver how do I approve claims?

If you have been designated as a substitute approver you will need to go to the tab “Claims requiring authorisation from others”. You need to click that tab and you can then approve any claims from other staff.

-

I am now responsible for approving staff expenses what do I do?

You will need to complete the e-Pay1 form and send it to AGCSU.esrsupport@nhs.net.

-

Do passwords expire?

Yes, every 90 days.

-

Can I claim for my eye test on e-Pay

Eye tests can be reclaimed via e-pay. There is a drop down called medical expenses. You will need to upload the receipt (not the eye test reimbursement form). Reimbursements are as follows:

Eye tests – Re-imbursed up to £25.00 maximum. (If there are specific medical circumstances the ICB may consider claims above this limit. Evidence would be required).

Glasses - Contribution is up to £45 (if criteria is met). Please complete this form.

-

How do I claim for train tickets?

You need to claim under Miscellaneous Travel.

-

Can e-Pay be accessed from home?

Yes, e-Pay can be accessed from home or work.

-

Where do I get help on learning more about e-Pay?

The e-Pay expenses guide is here. There are also two links on the top right of your e-Pay homepage: e-Learning and Help.

-

Can I claim excess travel if I have a salary sacrifice lease car?

If you claim excess trave (i.e. such as a change of your base) it is likely that this would trigger a substantial tax liability (called ‘car fuel benefit tax’) that is likely to outweigh the benefit of you claiming the excess mileage.

This is because travel from your home to your permanent workplace (including excess mileage as a result of a change in base) is defined under HMRC rules as private use of the car and the car fuel benefit would apply – i.e. this means anyone claiming home to work mileage for any reason would be subject to additional tax charges arising from the car fuel benefit charge.

In view of this, our advice is that salary sacrifice lease car holders should consider this information carefully before claiming for excess travel. This is because the likely tax charge may outweigh the benefit of claiming excess mileage. If a fuel tax surcharge is incurred because of a claim, then this will be an individual matter between the employee and HMRC.

-

Can I claim business travel if I have a salary sacrifice lease car?

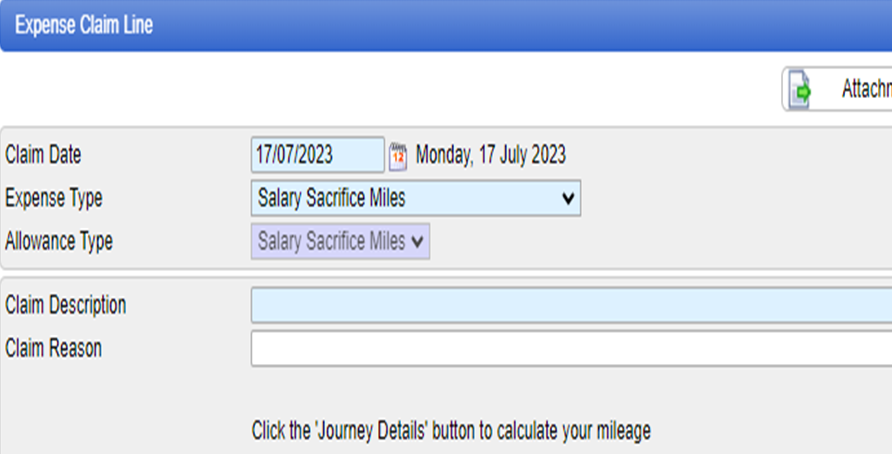

You can claim business miles, but you should use the salary sacrifice drop down box rather than business travel. Please see the screenshot below:

-

Can I claim the Passenger Allowance under Agenda for Change?

You can claim the Passenger Rate if you are carrying passengers in your vehicle for business travel, but you cannot claim this for transporting passengers to and from work as part of your normal daily commute. In these circumstances you can only claim for excess travel if you are entitled to do so.

-

I am eligible to claim for excess travel allowance following a change of base – what documentation should I provide?

All the following details must be provided to your manager. V5 registration document, driving licence (both parts if you have an old style licence) MOT certificate (if applicable), car tax and insurance certificate.

As you will not be making business mileage claims, your car insurance certificate does not need to cover you for business travel, however, if in future you will make business mileage claims, you MUST provide a copy of an updated certificate which does have business travel cover.

If your post requires you to undertake business travel you should ensure that your insurance covers you for business travel regardless as to whether you intend to make a claim or not.